- 1 Quick Answer

- 2 Why ROI Is the Real Decision Trigger in B2B POCs

- 3 The 5 ROI Metrics That Actually Matter in a B2B POC

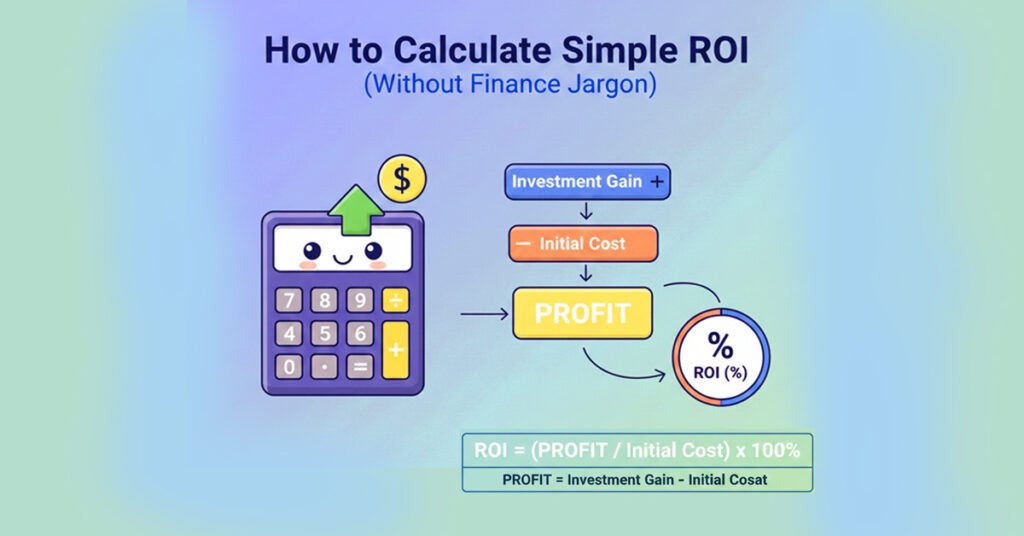

- 4 How to Calculate Simple ROI (Without Finance Jargon)

- 5 ROI Mistakes That Kill B2B POC Approvals

- 6 How to Present POC ROI to Decision-Makers

- 7 Frequently Asked Questions (FAQ)

- 8 Final Thoughts: ROI Is the Difference Between a Pilot and a Purchase

Quick Answer

The best way to measure ROI in a B2B POC is to compare one clearly defined business metric before and after the POC—such as time saved, cost reduced, revenue impact, or risk reduction—and translate that improvement into an annualized business outcome.

Successful B2B POCs in 2025 focus on 3–5 ROI-driven metrics agreed upon upfront, not vanity usage data.

If you’ve ever run a B2B POC that worked perfectly—yet still didn’t convert—you’re not alone.

I’ve personally seen multiple B2B POCs across SaaS, AI platforms, and enterprise tools where the product delivered real value, users were satisfied, and feedback was positive…

but the deal stalled anyway.

The reason was almost always the same:

No one could clearly explain the ROI in a way that justified a buying decision.

In 2025, B2B buyers don’t reject POCs because technology fails.

They reject them because business impact isn’t clear enough to approve.

This article explains exactly how to measure ROI in a B2B POC, using metrics that executives, finance teams, and buying committees actually trust.

For the full step-by-step process of designing and running POCs that convert, read our complete B2B POC framework for 2025.

Why ROI Is the Real Decision Trigger in B2B POCs

Modern B2B buying decisions are no longer driven by enthusiasm alone.

A typical POC approval must satisfy:

- Business users who want efficiency

- Managers who want performance gains

- Finance teams who want justification

- Leadership teams who want risk reduction

Features win demos.

ROI wins approvals.

Industry research from Gartner consistently shows that enterprise buying committees now require quantified value validation before approving production rollouts—especially for AI, analytics, and infrastructure tools.

If ROI is unclear, the safest decision is to delay.

And delayed POCs quietly die.

The 5 ROI Metrics That Actually Matter in a B2B POC

You don’t need complex dashboards.

You need credible, defensible metrics tied to real business outcomes.

These five metrics cover nearly every successful enterprise POC I’ve been involved in.

1. Time Saved (Operational Efficiency)

Time savings are the fastest way to establish value.

Examples:

- Hours saved per week

- Faster reporting cycles

- Reduced turnaround time for core workflows

Why it works:

Time savings translate directly into productivity and cost—making them easy to justify to non-technical stakeholders.

Example:

“Reporting time dropped from 20 hours per week to 9.”

That single sentence already communicates ROI clearly.

2. Cost Reduction

Cost reduction strengthens ROI by anchoring improvements in financial terms.

This may include:

- Reduced manual labor

- Tool consolidation

- Lower vendor or outsourcing costs

- Fewer rework cycles

From experience, conservative cost estimates build far more trust than aggressive projections.

3. Revenue Impact (When Relevant)

Not every POC directly affects revenue—but when it does, it’s powerful.

Revenue-linked metrics include:

- Faster deal cycles

- Improved conversion rates

- Better upsell visibility

- Improved customer retention

Even indirect revenue acceleration can support ROI if framed clearly.

4. Error, Risk, or Compliance Reduction

This metric is especially critical in regulated industries.

Examples:

- Fewer data errors

- Reduced compliance violations

- Lower operational or security risk

In 2025, enterprise buyers expect baseline compliance clarity during POCs. Standards like SOC 2 and ISO/IEC 27001 are now common evaluation checkpoints—even before production rollout.

Risk reduction may be qualitative, but it strongly influences executive approval.

5. Scalability Signal

Executives don’t approve POCs to solve one isolated problem.

They want to know:

- Can this scale across teams?

- Will it work with larger data volumes?

- Does it reduce future complexity?

Scalability is often qualitative—but it must be explicitly documented to support the buying decision.

How to Calculate Simple ROI (Without Finance Jargon)

You don’t need complex financial models.

At the POC stage, clarity beats precision.

A Simple ROI Method

- Establish the baseline

(time, cost, or risk before the POC) - Measure the post-POC state

(what changed and by how much) - Annualize the improvement

Example:

- 11 hours saved per week

- ₹1,500 average cost per hour

- Annual impact:

11 × 1,500 × 52 = ₹8,58,000 per year

That level of clarity is usually enough for approvals.

ROI Mistakes That Kill B2B POC Approvals

Even strong POCs fail due to avoidable mistakes:

- Tracking vanity metrics (logins, clicks, feature usage)

- No baseline data

- Too many KPIs

- No agreement on success criteria upfront

- Presenting technical metrics instead of business outcomes

If ROI feels vague, it feels risky.

How to Present POC ROI to Decision-Makers

Winning teams summarize ROI in one clear slide:

- Problem statement

- Before vs after metrics

- Business impact

- 12-month projection

- Clear recommendation

Avoid product language.

Instead of:

“The platform processed data faster.”

Say:

“The operations team saves 11 hours per week, reducing reporting delays and operational costs.”

That framing drives decisions.

Frequently Asked Questions (FAQ)

How long should ROI be measured in a B2B POC?

Most successful B2B POCs measure ROI over 14–30 days, then annualize the results.

Are usage metrics like logins important?

Only if they directly support business outcomes. Usage alone rarely drives approvals.

Should ROI be agreed upon before the POC starts?

Yes. Agreeing on success metrics upfront significantly increases conversion rates.

Can ROI be qualitative?

Yes—metrics like scalability and risk reduction are often qualitative but still highly influential.

Who cares most about ROI in a POC?

Finance leaders, executive sponsors, and procurement teams—not just end users.

Final Thoughts: ROI Is the Difference Between a Pilot and a Purchase

In 2025, B2B buyers are cautious, data-driven, and overwhelmed with options.

A POC that clearly demonstrates ROI:

- Builds confidence

- Reduces risk

- Accelerates approvals

- Converts faster

A POC without ROI becomes a “learning exercise”—not a buying decision.

To understand how ROI fits into the full POC lifecycle, revisit our How to Build a Successful B2B POC in 2025 guide.